tv Squawk Box CNBC December 4, 2012 6:00am-9:00am EST

6:00 am

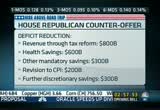

good morning. welcome to "squawk box." i'm becky quick with joe kernen. andrew is off this week. we have two guest hosts with us. welcome to both of you you. we have a lot of things to talk about. the white house says that a republican counteroffer does not meet the test of balance. the latest republican offer would overhaul the tax code and raise $800 billion in new revenue, it would also seek $600 billion in health savings and $200 billion for revising the cost of living increases for social security. the net savings would add up to $2.2 trillion over ten years. now, again, this is the republican counterproposal to the plan that the white house has already put out. speaker john boehner has said that this is something that is much closer to the

6:01 am

bowles-simpson proposal. erskine bowles saying the gop offer does not represent the plan, he says both sides are kind of far away from it at this point and that it's now up to negotiators to figure out where the middle ground is today. >> bowles said that the mid point that i used back in -- this is where we were last year. so used the mid point of the negotiations, but it's in longer the mid point i guess. >> he also said -- he is a testimony, but he has separated himself from the administration by saying that they thoo should have taken more of their proposals more seriously. he also said last night that you will see higher marginal tax rates. >> higher marginal or effective? >> higher mar begin ginal rates talking about last night. >> that's part of the 500. >> he thinks as part of the compromise to get there, you'll have to see the democrats get

6:02 am

their way in terms of higher marginal tax rates. he also said that the republicans should be able to see higher entitlement cuts, that that should be part of this conversation. >> obama doesn't listen to him at this point. do you see how this is on? it's as tenuous as the talks themselves. leechb one way or the other, it falls off. anything the slightest movement respect, and the cliff -- we're not rising above. you're getting a hum on my microphone? i'm fine. the audio guy. interrupts the show to tell me

6:03 am

there is a hum and there isn't a hum. >> i appreciate that. also senator harry reid says that republicans need to, quote, get serious. both sides are saying this, both sides -- a lot of kabuke theater. >> everyone got disgusted. nobody needs that image. >> the fiscal cliff will certainly be one of the main topics of discussion when president obama meets with some of the nation's governors today. actually i think they're meeting with vice president biden. then governors will be meeting with some of the congressional leadership, as well. but you guys are watching this, we know this is drama and theater. do you think a deal gets struck at the end of the day? >> i do. i have to say, i still think we'll get a last minute deal.

6:04 am

i just cannot imagine that congress will allow to us go over the cliff. so i think the ramifications for the economy are too significant. i think we're watching whatever you want to call it, all of the politics playing out, but i still think in the end we'll get a last minute deal. >> i agree. and i think even though the sides are far apart, you have things on the table now. so you can say you're here at 800, 1.6, you kind of -- it gets you somewhere close. somebody will try to say 1.3 versus 1.1, but if you see publicly what they're stating and hopefully privately other things are going on, but it will get done, but it will be very slow. >> john boehner with the proposal he put on the table, i did see commentary from some of the far right saying this is not an acceptable proposal. even his proposal is not acceptable. i did see comment it ter that came through. my question is does the president now have to alienate some of his far left base in order to reach a compromise.

6:05 am

>> i think you'll see both of them have to actually bring the parties together. because you won't get everybody happy. some of the people who got voted on the ticket side, no, never. but it will all be negotiations. >> howard dean wants to go over the cliff. he says that's the best way to accomplish what they want and a lot of people on the right that are start to go say that. so i don't know. i don't necessarily think that -- >> americans for prosperity, the note i saw yesterday saying speaker boehner's counteroffer leaves conservatives wanting. >> howard will tell us today, but he's on the record as saying i make the argument going off the cliff, i call it the slope, is the best deal progressive democrats are going to get. and i think that -- i don't think the president will alienate them. i think he's going to throw in

6:06 am

his -- >> he said no people on the far right who have said it's better if you go over because then you're in a situation where and you are lowering taxes rather than raising taxes. >> the bottom line really if you're on the right, you know if you really want to go up on the top 2%, fine. we'll go up on everyone and actually accomplish something. if you go back to before bush tax cuts, three quarters of the deficit is gone. it was supposed to sunset two years ago. when is a good time to let those things sunset? >> you're right, there's never a good time. >> maybe do something with the sequester, but let the tax cuts expire. >> although i have to say at this time it's too much i think in terms of the tax increase. >> we never want any pain. >> you're right. and we do need to get our fiscal house in order. but again, this is why the idea would be to come up with a

6:07 am

longer term plan where you could scale some of these things in and you have to come up with a plan that you'll stick to, otherwise you get into this where -- >> we never stick to anything. if we get another deal that is toothless and -- >> the markets will become even more skeptical because we've seen this before. but i have to say two things. i don't necessarily buy into the deal that there's a fiscal slope. i have to say on the tax side, one of the things we keep talking about is the amt. boy, that's something that will -- >> howard goes on and on. clinton tax rates on everybody. will it cause a problem? yeah, short recession, but we get defense cuts which republicans would never agree to otherwise, there are human service cut which is we won't like, but the least possible

6:08 am

damage. and it's a serious down payment on the deficit. the wall street people ringing their hands are really full of it. i'm not sure what. but full of something because they're going to see a big drop on wall street but it will come roaring back because somebody has done something. so you have him and all their friends and the right and all their friends and the president who i don't think if he can ever get out of campaign mode. it's a full on campaign again. putting one party into -- >> you're right, the amt will hit more people in the middle class and raise their effective tax rate to a higher rate than they were today. and you won't -- >> you have obamacare 4% on everyone, too.

6:09 am

>> if you lieu numerically, it doesn't make sense if one side says we're not going to race taxes on the middle class -- >> although republicans would probably bear the brunt of the blame for what would happen if we go over the fiscal cliff. the president is counting on that. >> which republicans? boehner doesn't get -- some of these guys go back to the auto parts shop where they came from before they were a tea party republican, wherever they -- you can't -- it's not a monday know lit. you can't get mad at the house. >> people pointed out some of the republicans were there and congress don't care. >> no, why would they? >> i don't necessarily think president obama cares that much either.

6:10 am

his leg legacy is about obamacare, redistribution. and you can't control the economy. you can divide the pie better, but it will have these cycles. bush messed things up. i did the best i could, but he'll redistribute and that will happen, we'll spread the wealth around. and i don't think he cares that much about it. >> you don't think he cares about -- >> his chief of staff during the cry says said you'll be -- this is job one, the crisis. and he go that's not enough. he wants to be transformative. i don't know. we'll see. i asked the first time around why isn't he more concerned with job growth, private sector, business, the economy. >> he is putting more stimulus in. >> that's smart. 25% spending or -- >> i'm saying that will be the line you get from the white house, that we're putting more stimulus into this, we're looking to protect the middle class to make sure they can

6:11 am

continue to spend. >> at 25% of gdp, i wouldn't think about anything except trying to rein in government. >> the truth of the matter, what's a starting to happen is that international investors, the fact that we cannot govern is going to really come home to roost. >> gld man says this is the first time he's seen people take it out of american markets. >> it's he supposed to work this w way. they can't govern either. >> i was so hopeful, i wasn't obviously thrilled with the election results, but i actually thought that result might be the result we needed to get thefshs done.

6:12 am

>> in a way you you have the situation where -- >> you extend 98 but not the 2? believing that story is so -- >> either raise them on everyone or raise them on -- either it will hurt the economy if you raise taxes or it's not. on 98 it won't hurt, on 2 it will -- >> we'll have more on this argument. in the meantime, let's talk about some of the other headlines. financial firms are gathering for the goldman sachs financial services contractors. a key presenter is brian money tha moynihan. we talked about his reports of planned fee increases. plus there was the issue of president obama's likely pick to follow tim geithner at treasury.

6:13 am

we talked about how buffett threw out jamie dimon's name. here is what moynihan thinks about that idea. >> i won't give individual names, but i think what warren is expressing a view which i agree with is that we need to have very bright, very talented and very broad experienced people help push this thing forward. because it's very difficult right now because of just the amount of stuff that can go on every day. don't miss his take on the fiscal cliff. >> time for the global markets report. ross westgate standing by london. and then i say kelly. is that -- >> it's me. i'm here. we're flip-flopping kelly and i. >> we were ready no anything there. i introduced you, but then i

6:14 am

tossed to kelly. so that's the way we'll keep it from now on. >> consummate professional. hedging your options. advancers barely outpacing decliners. very slim gains on the equity markets. but it is worth pointing out ft ftse 100 up nine out of the last ten sessions. ftse flat now. xetra dax up a quarter. cac 40 up around two thirds. ibex up half of 1% as well. spain have officially applied for bailout money. it is keeping yields well contained at the moment. 5.25%. a long way below that 6% level. italian yields also very well contained. lower today 4.41%.

6:15 am

and the betting now is can spain keep from having to go for an official omt bailout to beyond the german elections which is scheduled september to october next year. so that's the game we play despite they have will have i issuance in 2013. gilt yields, chancellor statement coming out tomorrow. construction pmi today a little bit weaker. concerns over the uk economy. so we'll see how investors take to what's probably going to be a loosening up of the budget targets the chancellor set when they came into power. so we'll keep our eyes on that. and at the moment today, more talks in brussels. the greeks now getting their buy back program approved 37 trying to sort out a single supervisor. i think these talks will be fairly tricky because there is a majority who bt with a tant the be supervisor for all the banks. german didn't like that. so those talks will go on longer than originally hoped.

6:16 am

but we are marginally higher going to the u.s. open. thank you. >> kelly, thank you. i'll just call you r kelly in now. >> that's not bad. >> ross, thank you. great to see you. when we come back on squawk, bank of america ceo brian moynihan in his own words, we caught up with him yesterday to talk about business, the economy and the looming figure. as we head into a break, bank of america, best performing dow component of the year. up about 77%. ♪ [ male announcer ] how could switchgrass in argentina, change engineering in dubai, aluminum production in south africa, and the aerospace industry in the u.s.? at t. rowe price, we understand the connections of a complex, global economy. it's just one reason over 75% of our mutual funds beat their 10-year lipper average. t. rowe price. invest with confidence. request a prospectus or summary prospectus with investment information, risks, fees and expenses

6:17 am

6:19 am

indicated up 14 points. unable to hold on to the gains we saw yesterday. you can sort of knefeel it with what's happening in washington. plus how many people are selling stocks just because they'll take their gains this year. because taxes will be higher next year. >> you're seeing people with if you have a large position in a company, this is probably the right time to take it. if it's a large percentage, 10%, 15%, 20% of your net worth, sell it now. >> and if you're planning to retire in the next three to five

6:20 am

years, you're probably better off doing your allocation change thousand than you are saying -- >> this might be awful next year, too. isn't moynihan going to -- if we go over the cliff, it's not going to be a great year for stocks. >> it won't be a great year for hiring. >> left's already started. everybody is hiring temporary workers. they're not buying. they're leasing. you have more up front costs because you're trying to defer any long tirm purchase. but that's been happening now for two months. so you can look at the other way and say if we actually get a resolution, you might have more certainty which we're all looking for and companies saying you can actually make a capital projection as opposed to really can't do anything because i don't know what my regulations and laws will be. >> i do think that's become actually more of a consensus type view which is that if we were to be able to find some resolution, get a little bit more certainty, there is some

6:21 am

pent up demand on the hiring side, on the which is i in-business investment side. you may actually see growth at 3% say. >> businesses will invest. consumers still have the ability because housing has helped them with the tail wind and you're seeing it in the auto cycle, you saw the sales yesterday and you'll see it increasing because interest rates are low, gas prices have come down, but businesses have the pent up demand and they didn't want to spend it because they don't know what's going to happen. >> let's bring in some of the sound from brian moynihan. we talked about a lot of things including the looming fiscal cliff. talked about business concerns as you head into the end of the year and even what to expect in 2014. bank of america has 55 million customers here in america. they represent one out of every two households. so moynihan has a very good idea about what consumers are doing and if they spending less because of the fiscal cliff. here's what he had to say.

6:22 am

>> i'm more about business behavior than consumer behavior. people continue to spend, housing is a little better. all the things that affect stock market are in decent shape. the question was will everything going on cause them on slow down again. >> what are you you see rg businesses right now? >> almost a year and a halving a go, businesses getting concerned about the nature of the dialogue about the fiscal situation? washington and in europe and the issues that had to be dealt with long term and how it affects near term business in terms of what would be accelerated appreciation for investment in business. what will be the final demand. so the uncertainty factor started weighing in and caused everybody to be much more cautious and continue to be more and more cautious worried about what might happen next. >> you're a member of the fix the debt organization. you're worried about what happens if we go over the fiscal cliff. play out the scenario for how things would go down if we actually do move past january 1

6:23 am

without an agreement. >> if you get lots of economist projections, you'll see the general view is the economy would have negative growth or a couple percentage points, whatever it is. near term recession impact. and that nt would be good to the economy because it's been moving its way out. what's really after people is will we be serious about fixing the long term problems of america's fiscal situation. basically having more revenue and less expenses so we can get the thing more if line. and that's pre-occupying people because they're worried about the longer term issue. if this doesn't move forward with a solution that actually starts to layout the ground work for the long term issues, it could be potentially disappointing. >> ceos say they have to lay out their plans for what they're planning on doing in january and they have to move forward with the plan that has an assumption that we don't get some sort of a solution. do you hear that from your clients? >> yes, absolutely. so i think it's not january.

6:24 am

they were forming these plans in august and september. so even leading up to that, people are becoming more conservative and i think that's had an impact on what the growth will be this 13 all things being equal and i think we're in danger if this strings out into 13 that you could start to have problems of what '14 would look like because they make their budget in a half year, corporations make their budgets early fall, and the decisions are should i build a plant, add new equipment, all that is pretty much done right now for '13. and you really talk about what happens next. and so my concern is we need to get a solution that has both they're term fixes for lack of a better term and longer term viewpoint that they'll be serious about if you get the confidence to have people actually speak about '13 into '14 being a very structure difference year. >> you've been to washington, you've spoken with lawmakers about this. have you told them these concerns about the short term fix and what it actually means? >> i try to do two things.

6:25 am

we're a big company. we have 270,000 people. but i say put yourself in the shoes of one of our clients that's a manufacturing company with 500 people and the amount of things that they nas. it they're probably more global than they were many years ago. so they're worried about whether china will go grow as fast. then you have the united states uncertainty. suddenly they pull back. and then they don't know the personal tax grow, and they pull back. so what i try to talk more about is what our clients see than what we see. because what i think we add value, we see 30,000 market companies in the country and by hearing from them, we can help arctic could you what the what they're seeing and how they're behaving. >> that is one of his huge concerns that at this point, it's too late to save anything with 2013 blaurly for small businesses and their plans in terms of hiring. for 2014, you could be tinkering with that at that point if this pushes in to 2013. and take's that's the biggest t

6:26 am

took away. we're really threatening 2014, too. >> i haven't heard so much that about the fiscal cliff. >> it was not just the fiscal cliff, it was time after time, the start of the debt ceiling talks and then they get pushed off, these are temporary fixes and it keeps coming. >> i guess one of the things that we kind of focus on is what happens after the fiscal cliff. because that just maybe gets you over the hump. this may be just a temporary fix to give them time to work out in 2013 perhaps a bigger deal, a grand bargain. but what does grand bargain mean. if you were able to cobble together a bigger deal, but a lot of people worry that's fiscal drag. and that will mean that as we move into '14, '15, growth will be a lot softer. >> you have to get confidence because. because if the consumer doesn't have confidence going into christmas and next year and saying i don't know what's going on, right now that's holding up our economy.

6:27 am

two-thirds of our economy is driven by the consumer actually starting to spend. business is dragging. you will see a multiplier effect on the negative side and 2014 will look worse because people won't travel, they won't buy. all advertising, you can just look at kind of going across the board and saying if businesses don't know what's going on and congress can't get back together and the consumer said i thought things were going to get better because consumers always spend more than they have, that's going to be pretty tough for this economy and the market really. >> not exactly the message we want to hear this morning. thank you both very much for coming in and spending time with us. >> coming up, a picture from the futures pit this is chicago. and later, first ceo then whistle blower and now author. the corporate leader who threw the yellow flag on olympus. next hour, c thnbc has named hi home the best for business. plus we'll hop behind the wheel of auto nation to talk sales, the economy and of course the

6:29 am

wooohooo....hahaahahaha! oh...there you go. wooohooo....hahaahahaha! i'm gonna stand up to her! no you're not. i know. you know ronny folks who save hundreds of dollars switching to geico sure are happy. how happy are they jimmy? happier than a witch in a broom factory. get happy. get geico. fifteen minutes could save you fifteen percent or more. two years ago, the people of bp made a commitment to the gulf.

6:30 am

bp has paid over twenty-three billion dollars to help those affected and to cover cleanup costs. today, the beaches and gulf are open, and many areas are reporting their best tourism seasons in years. and bp's also committed to america. we support nearly 250,000 jobs and invest more here than anywhere else. we're working to fuel america for generations to come. our commitment has never been stronger. well, having a ton of locations doesn't hurt. and a santa to boot! [ chuckles ] right, baby. oh, sir. that is a customer. oh...sorry about that. [ male announcer ] break from the holiday stress. fedex office.

6:31 am

welcome back to "squawk box." i'm joe kernen along with becky quick. andrew ross sorkin continues off. i figure he's in some type of rem sleep right now. i think he might be smelling the breakfast being cooked by the staff. and that's just stirring a little bit. because they start early i think to make the gourmet breakfast

6:32 am

down there and the gourmet coffee. the white house is rejecting a republican counterproposal to solve the fiscal cliff issue. the gop's ten year $2.2 trillion proposal raises the eligibility age for medicare up a couple years. it trims the cost of living increases for social security. and it brings in $800 million through tax reform. but it keeps bush era tax cuts in place for all taxpayers and that's something that the president says he will veto. a new player may be entering the takeover bidding for night capital. the journal reports that it's in you can takes to join vertu financial bid. virtu and get cco have offers o the table. and big lots reporting a loss of ten cents a share. full year profit forecast still

6:33 am

above street consensus. >> let's take a look at the futures. at least at this point are indicated higher. dow futures up by about 13 points above fair value. s&p higher, as well. nasdaq up by 4. yesterday dow down low to 60 points. and you did see stocks close right near the lows of the day. dow and s&p 500 were down for the first time in four days. also take a look at what's happening in europe. we spoke with ross a little earlier and you can see that right now there are modest gains there. in france, the cac up by about 0.7%. much more modest gains. ftse actually just about break even at this point. germany, the dax up by about 0.3%. in asia, you saw the hang seng was up just barely. korea was up just barely. the shanghai composite was up by close to 0.8%. and nikkei down by about a quarter percentage point. oil prices this morning pulling back a little bit. down another 33 cents to $88.76.

6:34 am

yesterday we did see oil cross above $90 for the first time since october 22nd. ended up down at about $89. but crossing early in the morning above $90. the ten year note at this point yielding 1.639%. i feel like we look at the same board board every morning. euro still up above 1.30. the dollar-yen at 81.99. and gold prices this morning slightly lower. down by about $15. $1704.40 an ounce. kevin ferry at the cme, kevin, we are watching the fiscal cliff every single day kind of watching negotiations as they play out. maybe that's not the wisest thing to do with the markets. what are the things that are popping up and have you thinking about stocks as we approach the end of the year? >> yeah, ats least it gives some

6:35 am

type of day trade headline trade ability to it, but i think two things that i point out real quick as you indicated, yesterday's reversal finished on the low tick for the s&p. so that drive as lot of negative sentiment. there was a cheering, traders were oriented towards a down day yesterday. so there was some facilitation of the idea that when the ism came in weaker. so watch the point of control for the s&p. probably around 1414. and it would have to be back above there to alleviate some of that negative sentiment. and the other thing -- go ahead. >> why were they cheering somewhat's the negative sentiment, what's the reasoning behind that? >> one thing about trading on the front lines is you always have to try and give yourself an idea of what the tone of the market is and the tone is definitely carrying over the past you few weeks a negative tone. in fact when the market goes up,

6:36 am

the theory is, oh, it's false or the data was contrived. so the orientation has been negative. and so as the market finally turned down yesterday since prior to thanksgiving, people were oriented towards that trade. again, it's where the point of control is. are people getting hurt on the way down or how is the setup. so it's been a stable night. so i think that the key is will the selling pick up again today. and the other point is the australian central bank cutting the rate. this was widely anticipated, one of the most popular trades you're hearing as ways to get short the australian currency against things. it's up this morning. so i'd be watching for people to start and put those trades on as the initial reaction from the cut was not the way people thought. >> there's been a lot of back and forth about whether or not the market has already factored in the whole idea that we could push past january 1st with the fiscal cliff talks.

6:37 am

if it that happens, there are two schools of thought, one is the market has already baked it in, and the other is if that were to actually happen, the market would put a lot more pressure on legislators to come up with a deal. which side are you on? >> i'd be somewhere leaning towards the second. i would definitely say that number one it facilitates the ability for people to get actionable in the marketplace even on a short term basis even if it's negative. and number two, i think that i was an early reader of the shock doctrine. i think it's been applied by both sides now. it's a manifesto for both sides. and that it's crisis management. they drive the market towards crisis as a way of facilitating their political agendas. i think it's folly, but a reality we've been faced with and i think that that's really what your coverage of it is accurate to the extent that

6:38 am

that's how politics gets done now. and i'm not a fan of it, but you have to really accept the reality of it. >> kevin, thank you. good to talk to you. >> sure thing. if you have comments or questions about anything you see here, e-mail us at squawk@cnbc.c squawk@cnbc.com. coming up, the ceo who ploou the whistle on his own company. michael woodford was running olympus until he discovered shenanigans and decided to say something. less than a year later, he's taking the concept of tell all to a new level. if you are one of the millions of men

6:39 am

who have used androgel 1%, there's big news. presenting androgel 1.62%. both are used to treat men with low testosterone. androgel 1.62% is from the makers of the number one prescribed testosterone replacement therapy. it raises your testosterone levels, and... is concentrated, so you could use less gel. and with androgel 1.62%, you can save on your monthly prescription. [ male announcer ] dosing and application sites between these products differ. women and children should avoid contact with application sites. discontinue androgel and call your doctor if you see unexpected signs of early puberty in a child, or, signs in a woman which may include changes in body hair or a large increase in acne,

6:40 am

possibly due to accidental exposure. men with breast cancer or who have or might have prostate cancer, and women who are, or may become pregnant or are breast feeding should not use androgel. serious side effects include worsening of an enlarged prostate, possible increased risk of prostate cancer, lower sperm count, swelling of ankles, feet, or body, enlarged or painful breasts, problems breathing during sleep, and blood clots in the legs. tell your doctor about your medical conditions and medications, especially insulin, corticosteroids, or medicines to decrease blood clotting. talk to your doctor today about androgel 1.62% so you can use less gel. log on now to androgeloffer.com and you could pay as little as ten dollars a month for androgel 1.62%. what are you waiting for? this is big news.

6:42 am

futures are indicated slightly higher. dow up by over 17. yesterday it was down 60. >> oracle accelerating its dividend payouts. second, third and four quarter cash dividends this month. that will help shareholder as void potential tax increases next year. the big winner, larry ellison with his 1.1 billion theirs, he'll get a payout of $199 million. he'll use that to wax his yacht. that's not like a lot of money for larry ellison. >> people have been saying this is a big deal, but isn't that what you want to have the chairman have the same as the shareholders? >> are they saying it's a degreedy ellison? the dividend at oracle is not

6:43 am

why you buy the stock. >> i don't know how you win. you want the top executives to get the same. >> less than three quarter of a percent yielder. anyway, our next guest is one of the world's highest profile whistle blowers. michael woodford was president and ceo of japan's olympus corporation. his dream job turned in to a nightmare when he discovered the company had hidden more than $1 million in investment losses. he has a new book out called exposure. you had been at the company for a while but you were not the president and ceo. >> i'd been with the company for three decades. but became president on the first of april and was fired as president and ceo on the 14th of october. so 6 1/2 months. >> was it the previous ceo that orchestrated this? >> yes, he's admitted his guilt. >> and chairman was in cahoots? >> the former chairman and ceo

6:44 am

became president. >> were you chairman, as well? >> no i wasn't. i was president and ceo. he remained chairman. he was known by many as the dr. evil character. and if you see his face, he looks like dr. evil and he was evil. >> it's hard to imagine. this is kind of a stunning story. just the idea that you could cover p broad losses. your problem was you looked and you saw the acquisitions that looked like ridiculous deals. advisers were getting paid something like 0% of the value of the deals. deals had to get written down and you spoke up about it.30% o of the deals. deals had to get written down and you spoke up about it. >> $700 million. the largest payment. nearest was rbs with $3 million. japan is like alice in wonderland. for me it was surreal. i found myself in the middle of this nightmare where the media were silent and the japanese institutions a month after i was

6:45 am

fired, the share price had fallen 81.5%. $7 billion had been struck off the value of the company. but the institutional japanese shareholders would not utter one word of criticism of the incumbent board or one word of support for the ex-president who was going through purgatory trying to expose this. >> when you got into the ceo's office, these acquisitions had been done in prior years. >> no one knew of them. >> what were you doing, looking around at some of the stuff going on and you said what is this? >> it was hidden. >> you got into the ceo office, you started -- because this sou sounds like something a cfo would uncover. >> this only came out when a whistle blower went to a small magazi magazine. but the main line media in japan didn't report it. and i started following it from there. >> that's how i was wondering why a ceo would look manage to

6:46 am

the looking into the actual financials. >> no, it came out. >> they might not listen to him, but they would listen to the ceo. >> hopefully, but they doesn't. 14 other directors despite overwhelming evidence, all remained utterly silent. i pleaded. they fired me and told me to get the bus it to the airport. >> is this the way business is done in japan? >> no wonder people skeptical of them. 81.5% -- southeastern asset management in the states, harris associates, the overseas shareholder was saying these people have to go. woodford should come back. >> was it a cozy board? >> it's the institutions, joe. >> you're saying -- you're throwing all japanese companies under the bus. >> there are good japanese

6:47 am

companies, but the institutional shareholders control the share registers and they wouldn't speak up in the most extreme circumstances. it couldn't -- >> to the point where you were concerned for your safety, too. >> links with anti-legislation forces. published a supposed leak against the links with anti-social forces. so i was pretpetrified for my l. when i challenged, i was protected like the american president with armed officers from the tokyo police around me. >> how much better is tokyo regulation than china? probably looks like a model compared to what's happening in china. >> today's news of the big four being challenged by the sec. china -- at least japan's a democracy. >> you're lucky you were blowing the whistle in japan and not china. you wouldn't be here. >> a good point.

6:48 am

>> it's a crazy story. i still can't get over -- >> the author of republicans at the gate did a review in the new york times and he said this story compares with a john grisham knowledge and it does. >> what was the 700 million, fees paid to banks? >> it was just false fees. one piece of paper. >> and who ended up lining the pockets here? >> the money went to the cayman islands. so we'll a never know the truth. part of it was just to try to use off balance sheet vehicles to write them down. >> this former ceo, has he got cayman island accounts? >> i don't think there's any evidence of personal gain. no evidence of that. but last month in japan -- >> who was the owner of cayman island accounts? >> we'll never know all the truth. we'll never know all the truth unfortunately. but the whole board had to stand down last year. the local boa

6:49 am

first time in the history of the knee nikkei. nmichael, thanks for joinin us. when we come back, we'll go to chairs. and then in the next hour, you know the slogan. don't mess with texas. the state's governor is in the squawk green room and he's our guest host. rick perry will tell us why companies want to do miss businn the lone star state. so, i'm happy. sales go up... i'm happy. it went out today... i'm happy. what if she's not home? (together) she won't be happy. use ups! she can get a text alert, reroute... even reschedule her package. it's ups my choice. are you happy? i'm happy. i'm happy. i'm happy. i'm happy. i'm happy. happy. happy. happy. happy. (together) happy. i love logistics.

6:50 am

try running four.ning a restaurant is hard, fortunately we've got ink. it gives us 5x the rewards on our internet, phone charges and cable, plus at office supply stores. rewards we put right back into our business. this is the only thing we've ever wanted to do and ink helps us do it. make your mark with ink from chase.

6:51 am

tdd#: 1-800-345-2550 after that, it's on to germany. tdd#: 1-800-345-2550 then tonight, i'm trading 9500 miles away in japan. tdd#: 1-800-345-2550 with the new global account from schwab, tdd#: 1-800-345-2550 i hunt down opportunities around the world tdd#: 1-800-345-2550 as if i'm right there. tdd#: 1-800-345-2550 and i'm in total control because i can trade tdd#: 1-800-345-2550 directly online in 12 markets in their local currencies. tdd#: 1-800-345-2550 i use their global research to get an edge. tdd#: 1-800-345-2550 their equity ratings show me how schwab tdd#: 1-800-345-2550 rates specific foreign stocks tdd#: 1-800-345-2550 based on things like fundamentals, momentum and risk. tdd#: 1-800-345-2550 and i also have access to independent tdd#: 1-800-345-2550 firms like ned davis research tdd#: 1-800-345-2550 and economist intelligence unit. tdd#: 1-800-345-2550 plus, i can talk to their global specialists 24/7. tdd#: 1-800-345-2550 and trade in my global account commission-free tdd#: 1-800-345-2550 through march 2013. tdd#: 1-800-345-2550 best part... no jet lag. tdd#: 1-800-345-2550 call 1-866-506-9616 tdd#: 1-800-345-2550 and a global specialist tdd#: 1-800-345-2550 will help you gearted today.

6:52 am

6:53 am

welcome back, everybody. we're in chairs talking about some of the stories that have caught our attention. taking profits on the plaza. the kingdom holding company sold a majority stake of the new york landmark hotel to a major indian conglomerate for $575 million. he'll be retaining a 25% stake in the hold. kingdom holding making $33 million profit on the deal. sticking with the -- >> royal theme? >> yeah, i guess. we haven't talked about it yet. >> but it's everywhere. >> it reminds me of the not the lottery story but seeing the brian williams it was, like, the second story was the lottery story, which i don't know. this is not the same, but it's probably incumbent upon us to at least reference it that they're going to have a baby, might be

6:54 am

twins, she was so dehydrated she needed to be hospitalized, they wouldn't have told us because you wait 12 weeks to tell us and supposedly the queen didn't know until yesterday. the guy or girl -- she would be become queen if she were a girl, king he'd be third in line. prince harry gets pushed back. >> do you really care who gets pushed back? who wants it? >> charles wanted it. he's 64 and the queen is 86 and her mother went to well over 100. >> yeah. >> charles is, like, 64 he's, like, you know, this is, you know -- >> never. >> and then next would be i guess william, but prince charles might not get it until he's, you know, he could be 80 years old before he finally gets it. and it -- there's a reason i guess this is kind of interesting. we love watching the royals. has shown me what it meant to be a person of privilege and rank in the old style, you know, we

6:55 am

don't have that kind of -- where you become -- >> i kind of feel sorry to them to not even be 12 weeks along and have the whole world talking about it and the odds makers. harry's in a better position. >> you think harry's in a better position? why because he can run around naked out in vegas? >> yes. >> which he does do frequently. >> all right. also we took a look at a story from the personal journal on gifting and the science behind regifting which is kind of interesting. >> yeah. >> did you know it's actually considered fair game 79% of the people they talked to a consumer spending survey said regifting is socially acceptable during the holiday period. but women do it more. women regift at a 50% greater rate than men and it's usually younger people, people under 30 years old are much more likely to regift it because they don't have a lot of money. >> it means you didn't really want whatever it is. >> or it means it could be the gift of the maji, where you get

6:56 am

something and give it on to somebody. you want to know -- >> i don't know what you mean, the gift of -- the three wise guys? >> yeah. you never read the story? >> i was born on the epiphany. >> you never read the story? >> i think i kind of read parts of it. >> not the epiphany part, the gift of the maji where she cuts off her hair -- >> she gives him a comb and -- >> yeah, yeah, yeah, it could be a situation like that. we'll take a quick break. it's a great love story, it means they love each other very much. when we come back, we'll have more of the top stories and governor rick perry. deep in the heart of "squawk," governor rick perry joins joe and becky on the set for making the case to do business in texas. everything's bigger there, so stay tuned. it's a new day.

6:57 am

if you're a man with low testosterone, you should know that axiron is here. the only underarm treatment for low t. that's right, the one you apply to the underarm. axiron is not for use in women or anyone younger than 18. axiron can transfer to others through direct contact. women, especially those who are or who may become pregnant, and children should avoid contact where axiron is applied as unexpected signs of puberty in children or changes in body hair or increased acne in women may occur. report these signs and symptoms to your doctor if they occur. tell your doctor about all medical conditions and medications. do not use if you have prostate or breast cancer. serious side effects could include increased risk of prostate cancer; worsening prostate symptoms; decreased sperm count; ankle, feet, or body swelling; enlarged or painful breasts;

6:58 am

problems breathing while sleeping; and blood clots in the legs. common side effects include skin redness or irritation where applied, increased red blood cell count, headache, diarrhea, vomiting, and increase in psa. see your doctor, and for a 30-day free trial, go to axiron.com. the latest coffee machine from nespresso. modular. intuitive. combines espresso and fresh milk. the new u. nespresso. what else? available at these fine retailers. can i still ship a gift in time for christmas? yeah, sure you can. great. where's your gift? uh... whew. [ male announcer ] break from the holiday stress. ship fedex express by december 22nd for christmas delivery.

7:00 am

rising above for job growth. >> the stars at night are big and bright -- ♪ deep in the heart of texas today's guest host texas governor rick perry is here to talk about the fiscal cliff and business opportunities in the lone star state. need a private jet? meet a disrupter who is changing the way corporate america travels. plus, more of our exclusive interview with bank of america ceo brian moynihan. how difficult does it make it to be a banker in this market? >> what they've been trying to do is help the economy. the second hour of "squawk box" begins right now. ♪ the stars at night are big and bright deep in the heart of texas ♪ ♪ the prairie sky is wide and high ♪ welcome back, everybody.

7:01 am

i'm becky quick along with joe kernen. andrew is off this week. we've are watching the futures and they are indicated slightly higher. the dow futures are up 14 points. they did end at the lows of the session yesterday down about 60 points for the dow. this morning in some of our headlines the white house is rejecting a republican proposal to avoid that fiscal cliff. the ten-year $2.2 trillion plan keeps bush-era tax cuts in place for all taxpayers. the white house has maintained that tax rates have to rise on the wealthy. australia is the latest country to lower interest rates, cutting its key rate a quarter point to the lowest level since the peak of the financial crisis. it was the bank's fourth rate cut this year amid worries about the global economy and the u.s. fiscal cliff issue. "the new york times" is seeking to trim staff they are offering buyouts to nonunion managers hoping to convince 30 to take a deal like that. the executive editor jill abramson said the layoffs would be necessary if the buyouts don't achieve the savings goal.

7:02 am

for the next two hours we're rising above with the governor whose state is cnbc's top state for business, governor rick perry of texas is here. good morning, governor. >> good morning. >> so great to have you in for two hours. it's a pleasure. you speak to so many things. you know a little bit about the latest presidential election and what finally happened and we want to hear what you have to say about the fiscal cliff as well, because i don't want to kiss up too much about texas, but texas to the rest of the country, we may not want to admit it pause it's such a big place and you got the cowboyses and you got all these iconic things happening down there. >> johnny football. >> and you got johnny football but things are going well in texas. they're not going quite as well in a lot of other places. people, say, well, it's oil and gas and they got handed all the natural resources, but when we had richard fisher in, he immediately points out there's a lot more positive things going

7:03 am

on in texas other than just the oil and gas industry. >> well, there are. and certainly we're happy that we've got the natural resources and have through the years. but they make up about 12% of our economy now. up from somewhere around 8% back in the early 2000s. so, they're an absolute godsend, but the fact is we have diversified our economy so much through the '90s and particularly the 2000s to a manufacturing type of background and state, if you will. so, the state is doing well. but as richard fisher will share with you, it's because we have put into place some relatively simple but profound practices of keeping the taxes low, the regulatory climate fair and predictable, a legal system that doesn't allow for oversuing. >> tort reform. >> we passed one of the most sweeping tort reforms in the

7:04 am

nation and passed looser pay to add to the next layer of that in the 2011 legislative session that continues to send the message of, listen, if you want to come and risk your capital, there is no place in america that you have a better chance to have a return on the investment than in the state of texas. we got a skilled workforce. continuing to develop that skilled workforce, and then try to get out of the way. i mean, government to get out of the way as best you can and let the private sector do what the private sector does best which is create the jobs, which in turn create the wealth. >> and, you know, when you hold it up as an example of what low regulation, low taxes, tort reform, you hold it up as an example, it's easy to see in individual states what happens when the opposite goes on and things leave, people leave. but we can't seem to take the experience in texas and extrapolate it to the country as

7:05 am

a whole. there's still arguments about whether low regulation helps, whether low taxes helps. and the problem is people look at texas and they will find little things, the left will find little things about texas. they'll say terrible in education. nobody's health care is covered. >> listen, if we were terrible -- >> and health care. >> -- but why would all the businesses copt to -- >> that's what they'll say. there's all the problems with texas. it's a horrible place. and nobody's covered by health insurance. the other knock is that i guess a lot of the business development is -- i don't know, what do they say, you've got these grants you give to private corporations. cronyism capitalism? >> we are competitive. >> they point to something and say what is it, federal, state grants to companies. >> it's called competition. >> is it crony capitalism? >> in the real world that's how you compete, you compete for

7:06 am

those businesses. listen rick scott in florida is a competitor, bobby jindal, susan martinez, they are all competing for those businesses. if you want to sit there -- i'll give you a good example. i think the martin o'malley, former -- or still -- former dn -- >> he's in virginia now, right? >> no. i think he's up in maryland. >> yeah, yeah, yeah, yeah. current governor. >> former chairman of the democrat governors association. he and i were on a panel one day. he's a bright, capable guy but he made the comment, you know, he was a little offended that a governor would come into his state and try to recruit businesses out of his state to go somewhere else. well, i understand that he might be offended, but the fact is that's how the world works. competition is what makes you stronger and putting legitimate competitive policies in place

7:07 am

whether it is grants to help a business move from a place that has overtaxed and overregulated to your state so that the people who work in your business can keep more of what they work for and to be able to take better care of their family is just good common sense and it's that competition is what i think drives america to be the best economy in the world. so the key is -- >> what are the states that are the most likely states that you can poach businesses from? >> illinois is obviously one of those states. as a matter of fact, when they raised taxes on their personal income tax rates, here about a year and a half or so ago, i can promise you mitch daniels was on the phone the next day over to the head of sears and the chicago mercantile exchange saying, hey, let's visit. we were on the phone pretty quick to them.

7:08 am

and now the legislature -- >> do you have companies that have left and -- >> oh, absolutely out of california, you know, that's a target-rich environment is what we refer to california. they raise taxes again. they sent the message that the unions are going to continue to control the process out there. they defeated proposition 32. they passed proposition 30 which was the increase in their taxes. so, california businessmen and women are looking at their bottom line saying, where are we going to go? other places? >> governor, is it too much of a leap to say when we do this at the federal level they leave the country, bilss can eventually leave the country. >> sure. >> but we can't seem to make the leap to say that. and i'm talking about the fiscal cliff now. i wonder if you were at 25% of gdp, if the government had grown to this size where it is right now and you were trying to figure out how to deal with it

7:09 am

and you were in charge, would it be all about -- would the first thing you come up with be raising taxes? would not -- wouldn't you address the spending -- wouldn't you address the spending side of -- >> right. >> -- and, you know, the republicans are trying to criticize the obama proposals by saying you're not cutting spending, you're not coming to us on entitlements, but it's falling flat. no one's really listening and the white house has controlled the debate that it's all about the upper 2%. the first thing in texas you do is shrink the size of government, wouldn't you? >> well, we did that. we faced a substantial budget shortfall. we have a constitutional amendment that requires us to have a balanced budget, which frankly america needs that. >> i don't know what would happen. >> most states have that. >> the states that are -- i would suggest to you the states that are doing better economically have a constitutional amendment that requires them to balance their budget. so, we had to deal with that in the early 2000s. and interestingly, it was the

7:10 am

first time since the 19th century, since back about 1870, that there were all republicans, republican speaker, republican house, republican lieutenant governor, republican senate and myself, and we had run on the premise that we were going to treat government differently, that we were going to treat it more like how folks in the private sector have to deal with their businesses, that we weren't going to raise taxes, that we were going to make the hard decisions about reducing spending and we did that. we filled a $10 billion budget gap in 2003. and here was the result. and i will suggest to you, this will be the result in america. yes, it's painful. yes, it's difficult to say no to all the special interests. but after we made those substantial reductions, 18 months later as we came back in for the next legislative session, we had an $8 billion

7:11 am

budget surplus. more money coming in than we had spent in the previous two-year period. so, there is a -- there are places in america where if washington wants to see what happens -- >> yeah. >> -- they can use my home state as an example of that. we've had experience with it. >> watching this cliff saga play out, i mean, what would -- how would you describe it right now? how do you -- do you think it gets settled? do you think that -- >> well -- >> he thinks we'll go over the cliff. he says that's the best way for progressives to accomplish the goals that they want and i see a lot of people on the right saying -- >> i'm not interested in somebody's political group being able to stand up and say we won and we came out of this better. what i'm looking at is what's best for america. >> what is best for america? >> well, what's best for america is for us to get our fiscal

7:12 am

house in order. >> the fiscal cliff and fiscal abyss, we've got to get through the cliff to settle the abyss. >> but the key issue is you must send the message to those that are going to create the wealth in the future and that's businessmen and women, that there's stability and predictability on all of these issues, on taxes, on the regulatory policy and they don't see that. i mean, there are -- i think approaching $2 trillion sitting on the sidelines. >> right. >> that is not going to be invested in this country because there is no predictability. there is no stability. they are scared to death about what washington's going to do next. and the reason texas is as stable, the reason people are moving to texas in record numbers, is because we have created that stability. >> but you won your election running on the idea that you were going to treat government differently. president obama claims that he won his election because he came up with this idea of saying that

7:13 am

they were going to raise tax rates on the wealthiest 2% and keep rates where they are for the middle-class. >> i think president obama can certainly say that he has got a different outlook on what america should look like, what america's role in the world should be, and a different outlook about the economic future of america. i think he truly believes his ideas. i don't think he's right in those beliefs and those outlooks because i think the human nature is to be free. the human instinct is to be free. free from overtaxation, free from overregulation, free from overlitigation. and until we free up the entrepreneurs in this country, we are going to struggle economically as a nation. there will be pockets around the country where freedom still

7:14 am

matters, where -- there is still a land of opportunity in america. it's called texas. >> anyway, they'll be more than -- we don't want you to secede now. how about five states? we're going to ask you about that. you're allowed to split into five states, aren't you? we could use those ten senators. are you allowed to do that? >> i'll be real honest with you, that's not going to happen. >> really? three states? two states? >> we'll maintain the state of texas the way that it is. >> i knew it. you like being big. if you split them up and be north texas and south texas. >> we'll continue to be a beacon for all people that want to live free. we're there come on down. >> the governor's going to be with us for the rest of the program. when we come back we've also got breaking news from autonation. we'll be talking car sales and the state of business. and later more of the interview with brian moynihan. will the bank be issuing a special dividend before the end of the year?

7:15 am

we'll have more of our exclusive interview coming up at 7:30 a.m. americans believe they should be in charge of their own future. how they'll live tomorrow. for more than 116 years, ameriprise financial has worked for their clients' futures. helping millions of americans retire on their terms. when they want. where they want. doing what they want. ameriprise. the strength of a leader in retirement planning. the heart of 10,000 advisors working with you one-to-one. together for your future. ♪

7:18 am

all right, gentlemen, let's check the futures right now. they are up 15 points. selling off yesterday. and auto parts retailer autozone which is a big eddie lampert company as you are, too, right? >> yes, we are a big eddie lampert company, that's correct. >> there you go. and you both start with auto, right? or auto. mike jackson is here. autozone is report iing revenuef 5.04 a share. autonation announcing november sales results today, we've got the ceo mike jackson with us. great to see you. >> becky, good to be with you. especially with fantastic sales results. retailed 22,500 in the month of

7:19 am

november an increase of 21% led by the resurgence of the asian products particularly the japanese which were up 27% led by honda which was up 45%. but the premium luxury business was also excellent up 25% led by bmw led by 35%. we run the whole gamut, the domestic business is up, particularly strong with ford and the great state of texas was particularly strong for us up 27% and the industry also had the best year since january of '08, a selling rate of 15,500,000 units, the auto industry remains a bright spot in the economy. we got through the debt crisis. got through gas crisis and got through the election and it looks like we're even going to rise above the fiscal cliff and have a strong close to the year,

7:20 am

so we're trying to do our part. >> you've been talking about how it's a huge issue for the fiscal cliff because the end of the year is such an important selling time, the last ten days of the year. >> the last ten days in the year in the car business every day's like christmas. it's -- you know, people work hard all year and at the end of the year they want to reward themselves for the effort. they have bonuses or they ju just -- up and business is extremely strong in the last ten days and all the production and all the marketing programs for all the manufacturers are all aligned for the strong year identify eyear-end close and it would be horrible to see the fiscal cliff disrupt the ten days or go over the cliff and get off to a bad start next year. >> just to be clear with the sales numbers everything you've seen in the first few days of the month of december, no slowdown from consumers at this point? >> i've come to the conclusion, becky, i just worry too much, you know? i've never seen anything like it. people genuinely need to buy new

7:21 am

vehicles, you know? we're taking clunkers in trade that have 150,000, 200,000 miles on it. they love the new vehicles and the dramatically improved fuel economy, the financing is better than ever. and they just have this faith or belief, whether it's well founded or not, that at the end of the day washington's going to do the right thing and get out of the way of this economy and come to some sort of agreement and not deliberately, irresponsibly throw us back into a recession. >> you just are announcing the purchase of two dealerships in dallas. >> we bought two exceptional dealerships in the great state of texas with annual revenue of $575 million. it's probably the largest transaction in the u.s. in over a decade that i can remember. and the first is in houston. spring chrysler dodge jeep ram. it's the largest dealership of

7:22 am

that type in texas. an extraordinary performer with extraordinary associates. but on our part, it's a statement that the resurgence, renaissance of chrysler corporation is real. it's sustainable. sergio marchione has done a walk-on-water, turnaround performance. i've seen the future, the future is strong and bright. >> and putting your money where your mouth is. >> you know me, you want to know what i think? just look what i do and that's what i think. and then in dallas-ft. worth an extraordinary group that we're excited to welcome those associates to our company. you know, i'm a big believer in the german and german vehicles. i started my career as a technician on german products. so, i have a special affinity for it. and we've acquired the boardwalk group which is a large audi

7:23 am

dealership, porsche and volkswagen dealership which will make us the largest volkswagen dealership in the great state of texas. and our german portfolio which i've been building over the last 13 years, represents 30% of the profitability of our company. and you know it, joe, you drive a porsche, they make extraordinary products. >> i had a loner and it was an audi and it was an a-6, brand new. >> amazing vehicle, amazing. >> i don't want to say anything about domestics but i would almost buy this car. >> here's how i see the world. germans have extraordinary differentiated -- >> the audi was never that great, were they? >> they are today. >> unbelievable car. >> and they have an extraordinary price. >> we got to go, but what are you selling in texas where i come from we driving trucks that song, do you sell a lot of trucks in the great state of

7:24 am

texas? >> we sell everything in texas. >> but not more trucks? >> i have to say about my friend the governor, what he said earlier about doing business in texas is all true. we want to -- the government solves problems in texas. we want to do something in texas, it happens two or three times faster in texas than it does in, say, the state of california. >> mike, thank you very much. >> thank you. >> great seeing you guys this morning. let's check the futures, traders focus on jobs this week as we get ready for the big employment report on friday. coming up, becky's exclusive interview with brian moynihan. [ penélope ] i found the best cafe in the world. nespresso. where i never have to compromise on anything. ♪ where just one touch creates the perfect coffee.

7:25 am

where every cappuccino and latte is only made with fresh milk. and where the staff is exceptionally friendly. ♪ nespresso. what else? melons!!! oh yeah!! well that was uncalled for. folks who save hundreds of dollars switching to geico sure are happy. how happy, ronny? happier than gallagher at a farmers' market.

7:26 am

7:27 am

♪ let's take a look at rock center there with the christmas tree up. up next, we'll have more of our special intervow with bank of america ceo brian moynihan. it's an interview you can't afford to miss and you can see it only right here on "squawk." coming up, silicon valley is giving private jet sharing a makeover. meet the ceo of black jet and find out how they can get you on your own jet in seconds. can i help you?

7:28 am

i heard you guys can ship ground for less than the ups store. that's right. i've learned the only way to get a holiday deal is to camp out. you know we've been open all night. is this a trick to get my spot? [ male announcer ] break from the holiday stress. save on ground shipping at fedex office. [ male announcer ] break from the holiday stress. if we want to improve our schools... ... what should we invest in? maybe new buildings? what about updated equipment? they can help, but recent research shows... ... nothing transforms schools like investing in advanced teacher education. let's build a strong foundation.

7:29 am

let's invest in our teachers so they can inspire our students. let's solve this. to provide a better benefits package... oahhh! [ male announcer ] it made a big splash with the employees. [ duck yelling ] [ male announcer ] find out more at... [ duck ] aflac! [ male announcer ] ...forbusiness.com. ♪ ha ha!

7:31 am

in the headlines president obama will meet with half a dozen governors today to discuss the fiscal cliff. three democrats, three republicans, say they're going to tell the president that failing to come to an agreement will leave the states with a big part of the bill. the white house rejected a gop counterproposal yesterday on the fiscal cliff. we don't know what's going on behind the scenes, hopefully something at this point, at least we know where the two, you know, polar areas are. oracle is accelerating its 2013 dividends payments. kind of interesting. it's going to pay its fiscal second, third, and fourth quarter dividends before the end of the year. the latest company to accelerate dividend payments to avoid higher dividend rates next year. and sprint is reportedly unlikely to make a counteroffer for metropcs. reuters said sprint will concentrate on closing its deal to sell up to 70% of itself to soft bank.

7:32 am

sprint pcs has agreed to a takeover. we've got more of our exclusive interview with brian moynihan. we also discussed the state of financials and the upcoming fed stress test. the banks have to turn in their capital plans to the fed by january 7th so i asked moynihan about the bank's dividend plan. >> we let everybody know and i think there's -- look work we fared well last year and i assume we'll farewell but i can't tell you what we'll ask for because we haven't finalized yet. >> you have done a good job of capitalizing yourself. analysts expect you to raise your dividends. >> after we get through it, i'll tell you what we did. >> you look at what the fed is doing and obviously it has a big impact on the environment for banking. some people call it qe infinity at this point not qe-3 but potentially qe-4, what does it mean for the long term and how

7:33 am

difficult does it make it to be a banker in this environment? >> when you say what the fed is doing with qe-2 and things like this, they're trying to help the economy. it's a big economy. the u.s. economy and the rest of the world's economy is so big once it goes in a direction it's hard to reverse that. the good news is it's been growing relatively stable the last several quarters and if we can keep that going it will materialize and produce the jobs and gain not as fast as we all want, we want it to be over and we want it back to 4 1/2% unemployment and 4% gdp growth, that's probably out there a while. but i think it's going forward. the key is what the fed is trying to do is keep the economy going forward and i think the chairman has been extremely clear about that, probably more so than they fed president before. it makes a very difficult earnings environment but i would rather have higher interest rates because it means the economy is growing and if it's growing we'll do better as an industry. we all want the economy to grow because that's a lot more fun to be around.

7:34 am

>> there has been the suggestion from some fed watchers that the fed would like to see interest rates go even lower in terms of mortgage rates and what you can offer. if i were a banker the idea of offering a 30-year mortgage at lower rates, hold on, there's a point we can't make the mortgages any longer if the rates couldn't to drop. >> i think you have to go to the investors that actually own the assets. there is an idea that if you -- if you get a mortgage now and it's so far below what we think is sort of normalized interest rates that as we say forever -- forever on your hips and momentary on your lips, and we manage the balance sheet very closely. so, a lot of mortgages we have we swap out the interest rate risk because of that as an industry and a company. we're all doing that. but i think that there is an issue about how low nominally people go at some point. but the mortgage market's working well.

7:35 am

it's just getting them all done. it's a lot of work to get this many mortgages through the system with all the rules and work we have to do. we're getting it through. we'll do more mortgage originators than we had the quarter before and the quarter before and we're back to year-over-year growth and we're pleased what's going on in the mortgage business but we have a lot more people than expected on the good side of the mortgage business generating mortgages right now. >> in the next hour we'll hear about a topic very important to a lot of banking kuls mers, that is fees. joe? howard dean joins our fiscal cliff conversation with governor rick perry of texas. and you've heard of uber, i know sorkin's heard of it. okay, yeah, the car service where you call wherever you are. what if you applied that concept to the private jet industry? you don't have to be megabucks. you need to be just -- you need to be megabucks but not as rich as owning a jet.

7:36 am

we'll bring you a disrupter that's doing that thee of black jet. pack your bags, this show is about to take off. tomorrow on "squawk box" an early read on the final employment report of the year. we'll get adp private payroll numbers at 8:15 a.m. eastern. plus, guest host greg fleming, president of morgan stanley wealth management. we'll ask him about the future of banking and the fiscal cliff. that's tomorrow starting at 6:00 a.m. eastern. ♪ [ engine revs ] ♪ ♪

7:37 am

[ male announcer ] the mercedes-benz winter event is back, with the perfect vehicle that's just right for you, no matter which list you're on. [ santa ] ho, ho, ho, ho! [ male announcer ] lease a 2013 c250 for $349 a month at your local mercedes-benz dealer. we believe the more you know, the better you trade. so we have ongoing webinars and interactive learning, plus, in-branch seminars at over 500 locations, where our dedicated support teams help you know more so your money can do more. [ rodger ] at scottrade, seven dollar trades are just the start. our teams have the information you want when you need it. it's another reason more investors are saying... [ all ] i'm with scottrade.

7:38 am

bp has paid overthe people of bp twenty-threeitment to the gulf. billion dollars to help those affected and to cover cleanup costs. today, the beaches and gulf are open, and many areas are reporting their best tourism seasons in years. and bp's also committed to america. we support nearly 250,000 jobs and invest more here than anywhere else. we're working to fuel america for generations to come. our commitment has never been stronger.

7:39 am

take a look at the futures. dow futures still up by about 15 points this morning. in our headlines baxter international is making the largest acquisition in its history. it's buying gambro for $4 billion. the deal's designed to boost baxter's present in the kidney dialysis market. is going over the cliff the best option for democrats? our next guest thinks so, and here to give us his theory on going over the cliff and how to solve the debt crisis, howard dean is the former governor of vermont and a cnbc contributor.

7:40 am

how are you? >> i'm good. >> we've talked when you've been in studio about parts of this, and i sort of knew you'd feel this way and i've told you, you know, we can do a lot with the deficit if we went back to the clinton-era tax rates. but they were supposed to sunset and it just never a good time it seems like. and if they do, three-quarters of the deficit is gone if they were all to sunset. is that that is right of your rationale? >> it's not just the clinton tax rates. we had a pretty good economy under bill clinton. >> different spending rates, too, back then, governor. >> well, that's right. it's also cuts in defense which we haven't had in 30 years and a cut in human services, which i'd rather not do, but i think everybody needs to something on the table to get what we need to get. it's the best deal for the country. we'll have a recession. the cbo thinks and i agree with this, we'll have 1.3% negative growth for two quarters and we'll go back with a slightly less than 2% growth rate for the

7:41 am

entire. we're not going to get out of this without pain. anybody when thinks we'll get through the deficit problem without having to do some sacrificing is wrong. what this does in my view as a democrat is it distributes the burden of the pain fairly, that is, we go back to the clinton tax rates for everybody, not just for rich folks. and we had a good economy under bill clinton. we go back -- we get -- cuts in defense spending which we know is higher than it needs to be and we cut some human services things like head start which i wish we didn't have to cut but this is going to have to be some sort of compromise. i think this is the best deal democrats are going to get. >> i know, you know, i can -- i can think like you at times because, you know, you're smart, you're a doctor, all these things. you're not going to -- >> i'm also a deficit hawk, joe. >> you are a deficit hawk. and, howard, i know obama won the election, but in this country you need the house to vote on something to make it law, and if they just say no the

7:42 am

39.6 on the high end, if you just let -- go over the cliff, it's going to 39.6. there would be in discussing it. it's going there. >> let's be fair about this. i mean, what i'm proposing is not -- neither the republicans nor the democrats like. because not only does it go to 39.6 on the wealthy which i support, but it also goes back to what people were paying when bill clinton was president for the middle-class and the truth of the matter is no matter what people said in the election, you cannot solve this deficit problem without everybody paying more taxes not just rich people. >> you can go to 100% and not 39.6. you'd like to in a perfect world, i know you, you would like to go to 100%. but you're not going to be able to do that. >> only on television personality. >> you go from raising, like, $80 billion a year which on a trillion dollar deficit is like kissing your sister and you go from $80 billion to, like, what, $700 billion, $800 billion if you let them all expire? >> we should let them all expire. i think the economy's much stronger than three years ago.

7:43 am

look, do i think it's painless? absolutely not. any politician that tells you we're going to get rid of the deficit in a painless way is not telling the truth. >> we keep pretending that there never needs to be any pain and we just keep extending and kicking things down the road and we'll be okay. and it just festers. >> and the good part about this is we don't need a vote from the house so if you want to get obstructionist it has to be my way or the highway, too bad. the vote's already been taken. the republicans already agreed to it, let's just do it. >> what do you ninthink, govern perry? it does mean job losses. we go back to 2%. that's what we did for 2012. >> there's a better way. >> this guy governed a real state, governor. >> let's see if there's a better way that everybody can agree on. >> yeah. >> let's hear it. >> i guess that's really what's at hand here is, howard, there is a great model for making the hard decisions for allowing the

7:44 am

taxes to remain low, and it sends a message to the business community that we're not going to take more away from you than what we already are taking. as a matter of fact, keep those -- keep the taxes low and it's the spending and the regulatory climate that has got the business community incredibly concerned, as well they should be. there is no stability, howard. there is no predictability out of washington, d.c., other than there's going to be gridlock and there's going to be continued spending and there's going to be continued taxation. i mean, the message that's being sent out of washington, d.c., right now is that we're not going to deal with this. we're going to let this thing go off the cliff and point, you know -- stand in a circle and point to the left and say it was his or her fault. and that is absolutely irresponsible. i think americans are looking for some leadership here and people who understand economics and understand how to run the --

7:45 am

in this case the united states of america, but, again, i go back to we have made this work in the state of texas. and if the last decade is an example of what would happen to america if we put these policies into place, it is the growth that's going to occur will be substantial. and that's how you pay off the deficit. >> we don't talk about growth anymore, governor. you really don't either. >> look, let's -- i think the texas economy is to be admired for its growth. it has done a very good job. on the other hand, you also have 22% of your children with no health insurance. >> told you. >> 20% of your adults with no health insurance. so, texas i think has had great economic growth, but there's also a lot of things about texas which other states don't particularly admire. my point is i take issue with you about the tax rate because the fact of the matter is 60% of the deficit in 2019 is caused by

7:46 am

the fact that the bush people cut taxes without paying for them by cutting spending. so, if you want to try to do this whole thing by cutting spending, be my guest, but you're not going to have many democratic votes. the fiscal cliff was agreed to by republicans and democrats. now nobody wants to pay the price. i say let's go ahead and get this done. the fact is it's actually a slope and not a cliff. we've got to get this done. i'm serious about deficit reduction. i don't think you can talk about deficit reduction without more taxes and cutting spending both. >> do you think the white house is ready? do you have people there with a wink and a nod, howard, that say you're right? >> i don't really know. i mean, they couldn't possibly say that, they're in the middle of a negotiation. and so we'll see what happens. but i believe that the country will get through this. there will be some pain in the next year. and the other thing i believe is that wall street who's moaning and groaning about this is actually going to do much better. because this is something i agree with rick about is

7:47 am